As businesses set their budget rates in the lead up to 2024, our experts weigh in on why it’s important to have one, how to arrive at the right rate for your business and which macroeconomic factors to consider in the process.

A budget rate is an internal reference exchange rate set by businesses with international cash flows. Hedging strategies are used to protect the budget rate. An effective budget rate allows businesses to improve their ability to forecast cash flows over a specific accounting period and effectively measure business performance.

To establish your business’ budget rate, first consider these two key principals:

- Attainability: Ensure that the rate you set is realistic and achievable.

- Objectivity: Stay informed. FX markets are influenced by many factors including macroeconomic events, monetary policy, geopolitical risk and black swan events. Therefore, it is hard to predict in which direction currency markets will move. For your budget rate to be effective, you need to keep a firm pulse on global events and market forecasts.

Fundamental drivers of currency moves

There are many factors that impact currency markets. Notable considerations for the upcoming year include:

- Inflation and interest rates: Which central banks will cut rates first? Whilst markets are anticipating disinflation, how might this roll out and what impact might this have on currency markets?

- Politics: In the upcoming year, markets are anticipating the impact of elections in both the US and UK.

- Geopolitical volatility: All eyes remain on the delicate Israel and Palestine narrative.

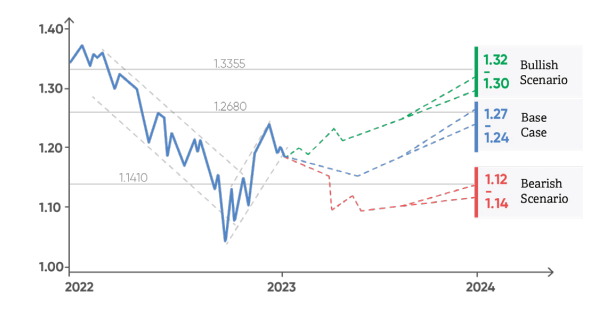

Scenario modelling

Outside of fundamental themes, when setting your budget rate, you need to create three broad scenarios to project where specific currency pairs might go and how this could potentially impact your business.

These broad scenarios are classed as:

- A bullish outlook, where one currency asserts itself over the other. Price action continues to drive higher in line with positive fundamental developments.

- The base case presents what you see as the likely path of price action given current fundamental expectations and volatility.

- A bearish scenario, where one currency weakens versus another, suffering declines in price action under the weight of negative fundamental and technical pressure.

Black swan and high volatility events are a reality that your business must plan for. As we haven’t had a high volatility event in 2023, you can generate scenarios with a degree of certainty.

The right approach for your business

There is no one-size-fits-all formula when setting a budget rate and the way a business sets and achieves its budget rate will vary. Contributing factors include:

- Certainty over forecasting cash flows: How confident is your business about the cash flows its forecasting for 2024? Forecasts should be attainable and realistic.

- Risk appetite: Gauge the threshold of volatility and risk at which your business is willing to trade.

- Resources: Aside from large multinational corporations, most finance departments have limited resources and a vast remit. FX is only one of the many areas that teams need to manage. Be realistic about how often you can monitor and analyse your exposure, as well as execute ad-hoc trades.

Include FX hedging parameters in your Treasury Policy

How you approach your budget rate should also be determined by your FX hedging policy, which is an integral part of your wider treasury policy.

Don’t overcomplicate it. The best FX hedging policy is simple, brief and can fit onto a single page and ideally is updated annually. Below is an example of a typical structure that businesses use when creating or refreshing their treasury policy.

You can split your FX hedging policy into five key sections:

Overview of your business’ FX exposure

What are you trying to achieve as a business and what problem are you trying to solve by creating this policy?

Objectives of your FX hedging policy: Protection of the budget rate and operating margins. Adhere to the set budget rate, protect operating margins and enable accurate forecasting.

- Certainty over your base currency costs and foreign currency exposure.

Parameters of your FX hedging policy

The parameters of your FX hedging policy outline how you operate within the capacity of your policy, and can be broken down into:

- The percentage of cash flow forecasts can be hedged.

- The maximum tenor of trades. Establish the maximum length of FX contracts that you’re willing to commit to.

- The minimum FX exposure that is required to be hedged.

Authorised foreign exchange products

Selecting an appropriate combination of products will largely depend on your appetite for risk, resources, certainty over cash flow forecast and your business objectives.

Some businesses will opt for certainty, choosing predominantly forward contracts where the rate is set for a specific period. Others will prefer the flexibility to buy or sell currency when the market moves in a favourable direction.

The following products could be used either in isolation or in conjunction with others:

- Spot trades: Achieve competitive exchange rates for immediate transactions.

- Forward contracts: Lock in a rate today for exchange on a specific date up to four years ahead.

- Market Orders: Enhance your hedging strategy with market orders to buy and sell currencies when the market hits your desired rate.

- FX Options: Structured hedging solutions for qualifying businesses, offering both premium-based and zero-cost alternatives.

Authorised decision makers: List the job titles of team members that can authorise trades on behalf of your business.

Setting a budget rate can help your business effectively forecast cash flows and plays a crucial role in financial planning for the year ahead, allowing you to better measure your international business performance.

For more detailed guidance on how to set your budget rate, watch our webinar ‘Top 5 Considerations for Setting your 2024 Budget Rate.’

To find out how our team of FX experts can help guide your business’ budget rate and treasury policy, please contact us via connect@argentex.com.

Disclaimer: Argentex LLP is authorised and regulated by the FCA for the provision of the investment services, FRN 781007, and for the issuing of electronic money, FRN 900671. This document specifically refers to those services offered by Argentex that do not fall within the scope of investment services – spot contracts and forward contracts that meet the mean payment exclusion criteria as defined in the MiFID II regulations. Nothing contained in this document should be construed as advice, a personal recommendation or inducement to deal in any MiFID II designated financial instruments. www.argentex.com